Woven Bag

HS Code for Non Woven Bags: A Comprehensive Guide

Understanding the HS code for non woven bags is crucial for businesses involved in importing or exporting these products. This guide provides detailed information on HS codes, their application to non woven bags, and the importance of accurate classification.

Example of a Non-Woven Bag with HS Code Label

Example of a Non-Woven Bag with HS Code Label

What is an HS Code?

The Harmonized System (HS) code is a standardized international system of names and codes for classifying traded products. Developed by the World Customs Organization (WCO), the HS code ensures uniform product classification worldwide, simplifying international trade. non woven polypropylene bags hs code are classified under specific HS codes, which are essential for determining tariffs, quotas, and other trade regulations.

Why are HS Codes Important for Non Woven Bags?

Accurate HS code classification is vital for seamless import and export procedures. Incorrect classification can lead to delays, fines, and even seizure of goods. Knowing the correct hsn code for pp non woven bags ensures compliance with customs regulations and facilitates smooth trade operations.

Decoding the HS Code for Non Woven Bags

Non woven bags are typically classified under HS code 3923.29 or other related codes depending on the specific material and intended use. This category generally covers articles of plastics, including shopping bags, tote bags, and other similar containers. Understanding the nuances of the code is crucial for accurate classification.

Common Materials for Non Woven Bags and their HS Code Implications

The material composition of the non woven bag plays a key role in determining the appropriate HS code. Common materials include polypropylene (PP), polyethylene (PE), and other synthetic fibers. The specific type of material influences the final HS code classification.

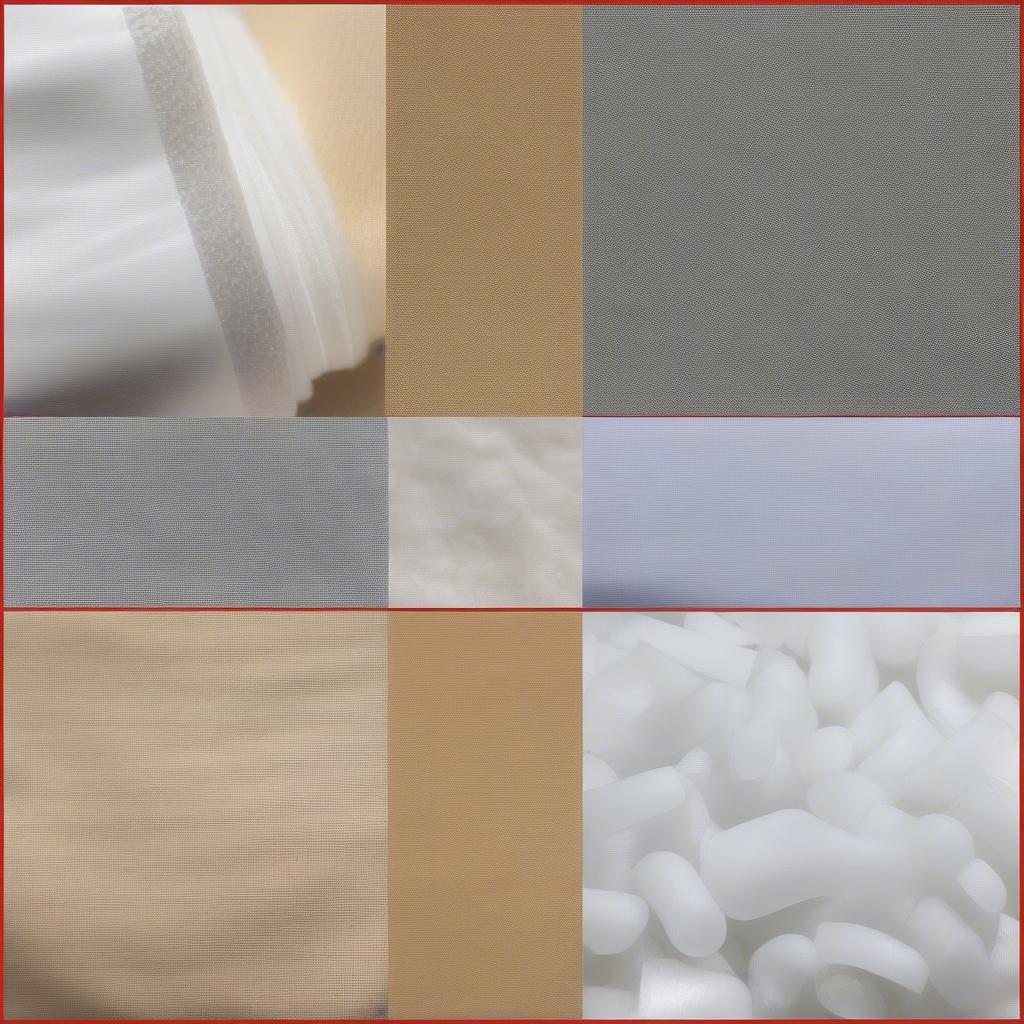

Different Materials Used in Non-Woven Bags

Different Materials Used in Non-Woven Bags

-

Polypropylene (PP) Non Woven Bags: hsn code for non woven bags made from polypropylene often fall under HS Code 3923.29. This code specifically covers articles for the conveyance or packing of goods, of plastics.

-

Other Material Considerations: Bags made from other materials like PET or recycled materials may fall under different subheadings within chapter 39 or other related chapters.

“Understanding the material composition is the first step in correctly classifying non woven bags for import and export,” explains John Miller, a leading expert in international trade regulations.

Factors Affecting HS Code Determination for Non Woven Bags

Besides material composition, other factors influence the HS code classification:

-

Intended Use: The intended use of the bag, such as for shopping, packaging, or promotional purposes, can impact the HS code. For example, non woven bags hsn code for promotional purposes might have different classifications than those intended for retail packaging.

-

Size and Dimensions: The bag’s size and dimensions can also play a role in classification.

-

Additional Features: Features such as handles, zippers, or compartments can further refine the HS code.

Features of Non-Woven Bags Affecting HS Code

Features of Non-Woven Bags Affecting HS Code

Navigating HS Code Challenges

Determining the correct HS code can be complex. Consulting with a customs broker or trade expert is recommended for businesses unsure about the correct classification.

“Accurate HS code classification is crucial for avoiding costly delays and penalties. Don’t hesitate to seek professional advice when needed,” advises Maria Garcia, a seasoned customs broker with over 20 years of experience. non woven tote bag hs code is often a point of confusion, and expert guidance can be invaluable.

Conclusion

Understanding the HS code for non woven bags is essential for businesses involved in international trade. Accurate classification ensures compliance with customs regulations, facilitating smooth and cost-effective import and export operations. By considering the material composition, intended use, and other relevant factors, businesses can accurately classify their non woven bags and avoid potential issues.

FAQ

- What is the general HS code for non woven bags? Generally, non woven bags fall under HS code 3923.29 or related codes.

- Why is accurate HS code classification important? Accurate classification ensures compliance with customs regulations, avoids delays and penalties, and facilitates smooth trade.

- What factors affect HS code determination? Material, intended use, size, and additional features influence the HS code.

- Where can I find more information on HS codes? The World Customs Organization (WCO) website provides comprehensive information on HS codes.

- Do I need a customs broker to determine the HS code? Consulting with a customs broker or trade expert is recommended, especially for complex cases.

- What are the potential consequences of incorrect HS code classification? Incorrect classification can lead to delays, fines, and seizure of goods.

- How do I determine the HS code for non-woven bags made from recycled materials? Consult the WCO website or a customs expert for specific guidance on recycled material classifications.

Need assistance with HS codes or other trade-related matters? Contact us at Hanoi, Vietnam or Tech Avenue, Suite 12, San Francisco, CA 94105, USA. Our 24/7 customer service team is ready to help.