Woven Bag

Understanding GST on Non-Woven Bags

Non-woven bags have become increasingly popular due to their eco-friendly nature and durability. Understanding the GST (Goods and Services Tax) implications on these bags is crucial for both businesses and consumers. This article will delve into the specifics of Gst On Non Woven Bags, covering everything from applicable rates to HS codes. gst on non woven bags

Decoding the GST Rate for Non-Woven Bags

The GST rate for non-woven bags in India is currently 18%. This applies to most types of non-woven bags, regardless of their size or intended use. This standardized rate simplifies tax calculations for businesses dealing with these products.

Factors Affecting GST on Non-Woven Bags

Several factors can influence the final GST amount on non-woven bags. The quantity purchased, any applicable discounts, and the state where the sale takes place can all play a role.

- Type of Non-Woven Bag: While the standard rate is 18%, variations may exist for specific types of bags, like those with specialized coatings or printing.

- Usage: Whether the bags are for retail, packaging, or promotional purposes might influence the final GST calculation in certain scenarios.

- Customization: Bags with extensive customization, such as complex printing or embroidery, might fall under a different tax category.

GST Application on Non-Woven Bags

GST Application on Non-Woven Bags

HS Code and GST for Non-Woven Bags

The Harmonized System (HS) code is a standardized system of names and numbers used worldwide to classify traded products. Knowing the correct HS code for non-woven bags is crucial for accurate GST application. The typical HS code for non-woven bags is 6305, which falls under the 18% GST slab. However, depending on the specific material composition, the HS code can vary.

Determining the Correct HS Code

non woven packaging bags gst rate Accurately determining the HS code for your non-woven bags requires considering the materials used in their production. For instance, bags made primarily of polypropylene will have a different HS code than those made from a blend of materials.

“Understanding the nuances of HS codes is essential for businesses involved in importing or exporting non-woven bags,” says Anita Sharma, a Senior Tax Consultant at Global Trade Solutions. “An incorrect HS code can lead to penalties and delays in customs clearance.”

Navigating GST for Businesses Selling Non-Woven Bags

Businesses selling non-woven bags need to be well-versed in GST regulations to ensure compliance and avoid penalties. This involves proper invoicing, accurate GST calculation, and timely filing of returns.

GST Compliance for Non-Woven Bag Retailers

non woven bags gst rate Retailers must clearly display the GST component on their invoices for non-woven bags. They also need to maintain accurate records of all transactions involving these products.

“Maintaining detailed records of GST transactions related to non-woven bags is paramount for a smooth audit process,” advises Rajesh Kumar, a Chartered Accountant specializing in retail businesses. “This includes purchase invoices, sales invoices, and GST returns.”

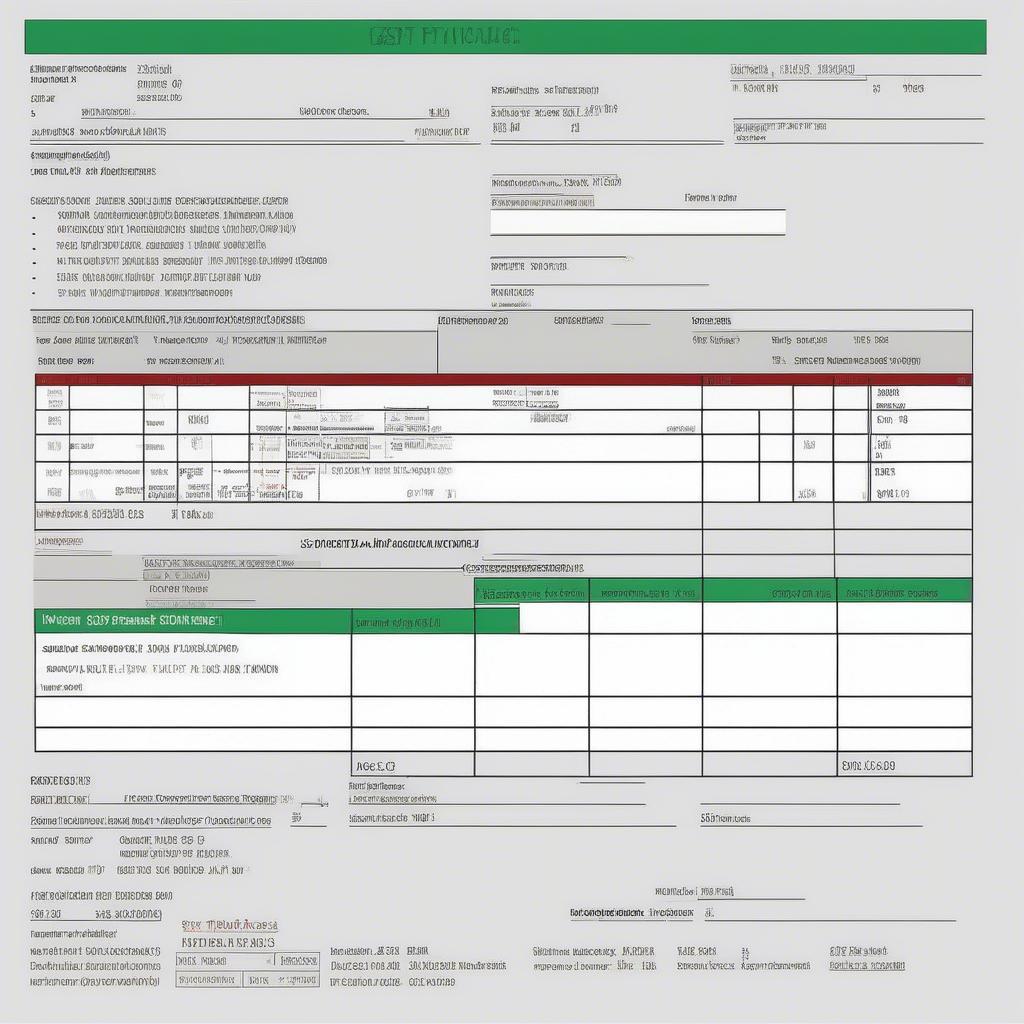

GST Invoice for Non-Woven Bags

GST Invoice for Non-Woven Bags

Conclusion

Understanding the gst on non woven bags is crucial for both businesses and consumers. By being aware of the applicable rates, HS codes, and compliance requirements, businesses can ensure smooth operations and avoid potential legal issues. non woven bags hs code gst rate Consumers, on the other hand, can make informed purchase decisions by understanding the tax implications.

FAQ

- What is the current GST rate on non-woven bags?

- How do I find the correct HS code for my non-woven bags?

- What are the GST compliance requirements for businesses selling non-woven bags?

- Are there any exemptions for GST on non-woven bags?

- How does GST impact the final price of non-woven bags for consumers?

- Where can I find more information about GST regulations in India?

- What are the penalties for non-compliance with GST regulations?

Need help? Contact us at Hanoi, Vietnam or Tech Avenue, Suite 12, San Francisco, CA 94105, USA. We have a 24/7 customer service team.