Woven Bag

HSN Code for Woven Bags: A Comprehensive Guide

Understanding the Hsn Code For Woven Bags is crucial for both businesses and consumers involved in the import and export of these products. This article will delve into the specifics of HSN codes for woven bags, covering various materials, types, and applications.

Decoding the HSN Code for Different Woven Bag Materials

Woven bags come in a plethora of materials, each impacting its HSN classification. The material composition directly influences the applicable code, impacting customs duties and trade regulations. Let’s explore some common materials:

- Jute: Woven bags made from jute often fall under HSN code 4202. This category encompasses articles of jute or of other textile bast fibres, such as sacks and bags.

- Cotton: Cotton woven bags typically fall under HSN code 4202 or 6305, depending on the specific construction and intended use. This differentiation is essential for accurate classification.

- Synthetic Fibers: Bags woven from polypropylene (PP) or other synthetic fibers often fall under HSN code 3923 or 6305 depending on whether they are classified as plastic articles or sacks/bags. pp woven bags hsn code provides a more in-depth look at this specific category. Understanding these nuances is vital for compliance.

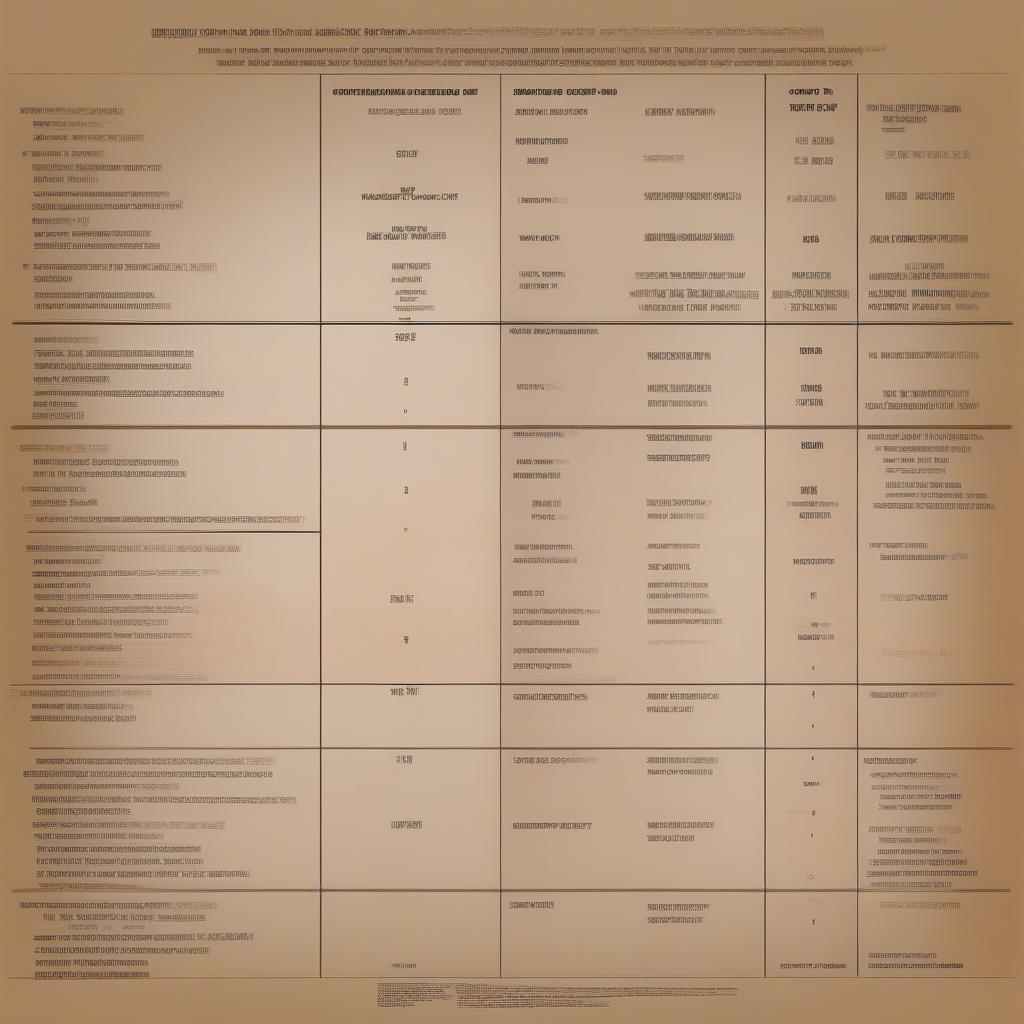

Different Materials for Woven Bags and Their HSN Codes

Different Materials for Woven Bags and Their HSN Codes

Navigating the Complexities of HSN Codes

HSN codes are structured hierarchically, allowing for precise categorization based on material, construction, and intended application. This detailed classification system ensures accurate tracking and assessment of goods in international trade.

- Two-digit codes: Represent broad categories of goods.

- Four-digit codes: Narrow down the category further.

- Six-digit codes: Provide the most specific classification.

- Eight-digit codes: Offer even further specification, often used for national tariff lines.

“Accurate HSN code classification is paramount for seamless international trade. It minimizes the risk of delays, penalties, and confusion with customs authorities.” – Sarah Miller, International Trade Consultant

Why Knowing the Correct HSN Code is Important

Using the correct HSN code is paramount for several reasons:

- Accurate Customs Duty Calculation: The HSN code determines the applicable customs duties and taxes, impacting the overall cost of importing or exporting woven bags. hsn code of non woven carry bags can help you understand the codes related to non-woven bags.

- Compliance with Trade Regulations: Correct classification ensures compliance with international trade agreements and regulations, avoiding potential legal issues and penalties.

- Streamlined Logistics: Proper coding facilitates efficient customs clearance, reducing delays and ensuring smooth movement of goods across borders. non woven bags hsn code in gst offers further insight.

HSN Code for Woven Bags and GST in India

In India, the HSN code system is integrated with the Goods and Services Tax (GST) framework. Knowing the correct HSN code is crucial for determining the applicable GST rate for woven bags. hsn code for non woven carry bags can provide further clarification on GST implications. This integration simplifies tax administration and ensures uniformity across the country.

“Understanding the interplay between HSN codes and GST is essential for businesses operating in India. It simplifies tax compliance and allows for accurate cost calculations.” – Rajesh Sharma, GST Consultant

Finding the Correct HSN Code

You can find the correct HSN code for woven bags by referring to the official HSN code list published by the World Customs Organization (WCO) or by consulting with a customs broker or trade expert. hsn code for non woven carry bag provides a convenient resource for quick lookups. This diligent research ensures accurate classification and minimizes potential complications.

Conclusion

Knowing the correct HSN code for woven bags is crucial for navigating international trade regulations, calculating customs duties, and ensuring smooth logistics. This understanding empowers businesses to operate efficiently and comply with legal requirements. By consulting reliable resources and seeking expert advice, businesses can accurately classify their woven bag products and avoid potential pitfalls in global trade.

FAQ

-

What does HSN stand for? HSN stands for Harmonized System of Nomenclature.

-

Where can I find the official HSN code list? The official HSN code list is published by the World Customs Organization (WCO).

-

Do HSN codes change? HSN codes can be updated periodically, so it’s essential to stay informed about the latest revisions.

-

How many digits are there in an HSN code? HSN codes can have 2, 4, 6, or 8 digits, with increasing specificity.

-

Is the HSN code the same globally? The first six digits of the HSN code are generally consistent globally, while the last two digits can vary by country.

-

What are the implications of using the wrong HSN code? Using the incorrect HSN code can lead to customs delays, penalties, and legal issues.

-

How can I get help with HSN code classification? You can consult with a customs broker, trade expert, or refer to online resources for assistance with HSN code classification.

Need more help understanding HSN codes? Check out our articles on specific woven bag materials and GST implications.

For assistance, contact us at Hanoi, Vietnam or Tech Avenue, Suite 12, San Francisco, CA 94105, USA. We have a 24/7 customer support team.